There is quite a lot of news in the Three Village School District from a Property Tax perspective.

What do your neighbors know that you don’t?

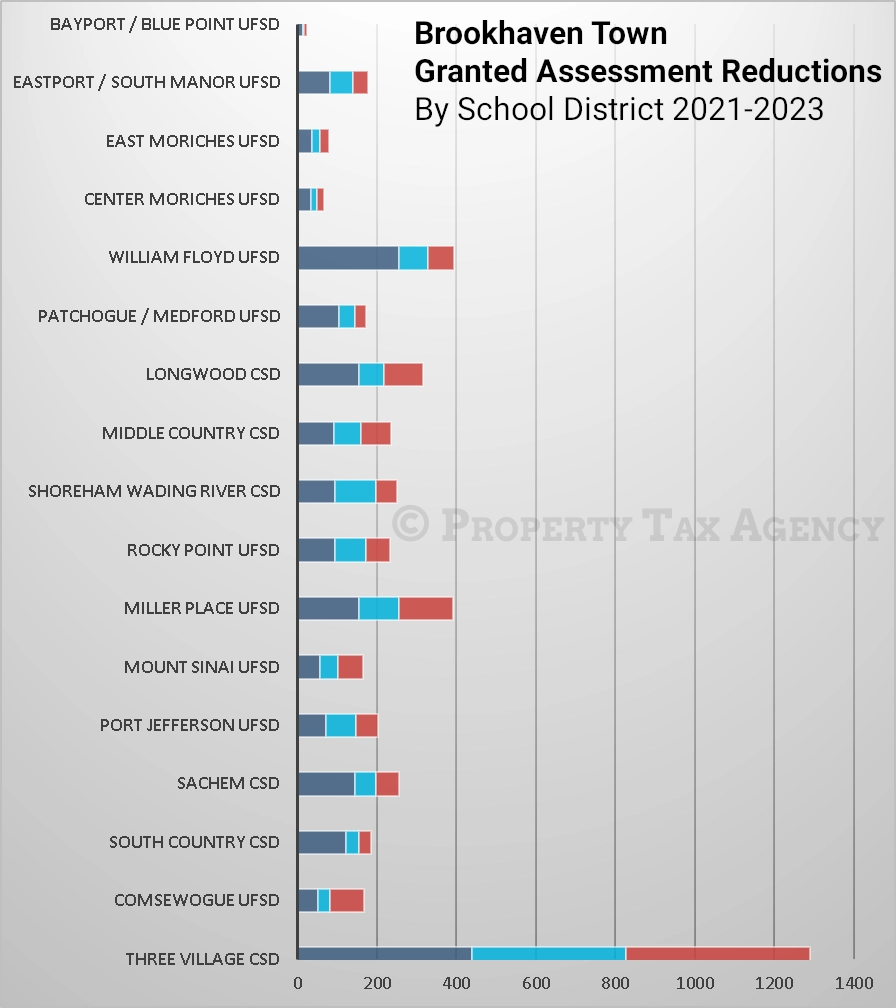

Over the last 3 years, Three Village has – by far – seen the greatest number of granted Assessment reductions in the Town of Brookhaven.

In fact, in each of the last 3 years Three Village has seen more granted reductions than just about any other School District in the Town’s combined total over that 3 year period.

Potential Changes in State Aid

Additionally, recently Governor Hochul has announced proposed changes to the calculations for determining State aid for School Districts – changes that could have an enormous impact on the budget for the District.

Estimates of the proposal indicate that Three Village could see a roughly $9 Million reduction in State Aid, a remarkable nearly 18% proposed reduction for the District, despite having already been designated as “susceptible to fiscal stress” by the State Comptroller.

The District Superintendent has sent an email to residents, outlining the potential impact of these proposed cuts to State Aid, which almost certainly would not be able to be fully offset by Property Tax increases.

The Potential Impact on Property Owners

Large reductions in State Aid could require reductions in services provided by the District, in addition to increasing the Property Tax Rates, to try to offset would could be drastic budget cuts.

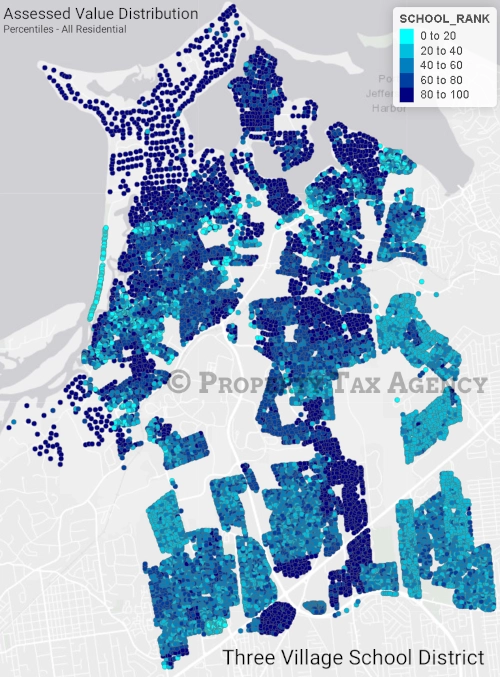

Granting of widespread Assessment Reductions will redistribute the responsibility for the Tax Levy, requiring a greater share be absorbed by the properties that are not granted lowered Assessments.

Property owners should be very concerned about both of these developments; School Districts are incredibly important in regards to property valuation on Long Island, and comprise the majority of Property Taxes for most owners.

As even the New York State Department ofTaxation and Finance has noted, Property Taxes are a Zero-Sum game: what one property owner doesn’t pay will be picked up by someone else.

Three Village School District property owners should contact Property Tax Agency today to grieve your assessment.